Some entrepreneurs see writing a business plan as little more than homework before they get to the real work starting their business.

The reality is that businesses with written plans are 133% more likely to get funding than those without one. Additionally, 82% of failed businesses collapse due to cash flow problems – problems that well thought out business plans can often help to identify before they tank a business..

Airbnb started as three guys who couldn’t afford rent and decided to rent out air mattresses in their apartment. Spotify began with a simple idea to make music more accessible. Both could have easily stayed as “wouldn’t it be cool if…” conversations, but their founders actually wrote down their business model and how they’d turn their ideas into real businesses.

Below, we’ll walk you through the 10 most important reasons your business needs a plan, plus real examples of companies that thrived because they planned ahead.

Key Reasons Why Planning a Business is Important

While some entrepreneurs prefer to “figure it out as they go,” goal-oriented entrepreneurs who start with a solid business plan consistently perform better.

A business plan increases the chances of success in these 10 key ways:

1. Provides Clear Direction and Focus

Your business plan serves as your North Star that guides every decision. It defines the objectives of your business strategy and sets measurable targets, such as revenue milestones, customer numbers, and market share.

Without these defined goals, you can’t make strategic decisions about how to achieve them. Should you spend your limited budget on Facebook ads or Google ads? Should you expand to a second location or invest in online sales? Your business plan has the answer.

Startups need this clarity most because they make countless daily decisions with limited resources and no track record. A plan helps you choose based on strategy rather than gut feelings or panic.

Consider Quibi‘s failure. Even with $1.75 billion, the streaming service closed after eight months because it didn’t plan properly for what users actually wanted.

2. Clarifies the Target Market and Customer Needs

Good market research tells you who your customers are, what they value, and how they make purchasing decisions. This knowledge helps you decide on product features, pricing, and marketing messages.

You can’t serve everyone, so your business plan forces you to choose your target market through customer segmentation. It assesses the market opportunities of each segment and projects future growth in your chosen markets.

Your plan should answer these important customer questions:

- Who exactly are your customers? (age, income, location, job title)

- What problems are they trying to solve?

- How do they currently solve these problems?

- What motivates them to buy?

- Where do they go to research and buy products like yours?

Shopify succeeded by targeting small business owners who wanted to sell online but lacked technical skills. Instead of trying to serve all e-commerce needs, they focused on solving specific pain points for this segment. This helped them clarify customer needs and create exactly what customers wanted.

McKinsey research shows that companies that focus on specific customer segments can boost revenues by 5 to 15 percent. Your business plan provides the structure to find and focus on your ideal customers.

3. Attracts Investors and Funding

Investors want to see how you’ll generate revenue, not just a good idea. Your business plan demonstrates the feasibility of your venture and serves as proof that you understand your market, competition, and financial projections well enough to succeed.

Investors need specific data to evaluate risk and potential returns: revenue forecasts, customer acquisition costs, profit margins, and cash flow projections. Without these numbers, they can’t determine if your business will generate the returns they expect.

Banks and lenders also require coherent, well-researched business plans before approving loans. Industry research shows that businesses with formal plans are 133% more likely to secure investment capital than those without.

Airbnb‘s original business plan shows how a well-written plan secures funding for innovative ventures. They showed specific revenue projections, user acquisition strategies, and market opportunity analysis that convinced investors of their potential.

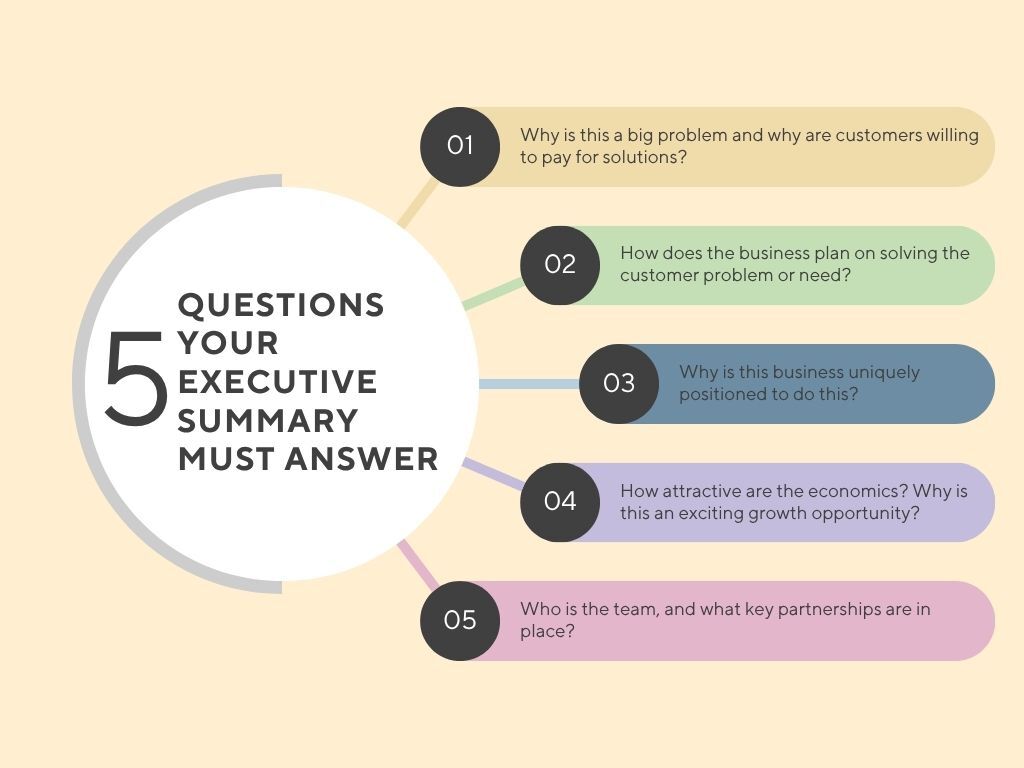

Pro Tip: Investors decide within the first few minutes whether to keep reading your plan. Create a persuasive executive summary with your strongest numbers, promising market opportunity, and clear path to profitability to grab their attention immediately.

4. Helps in Identifying Potential Risks

Your business plan works like a map that shows obstacles before you hit them. It evaluates the potential risks of your venture and helps entrepreneurs spot threats and prepare solutions instead of panicking when they happen.

Every new business faces four main types of risk:

- Technology/Product:

- Will your product actually work? What if development takes twice as long as expected? Plan backup features, test early with real users, and identify alternative suppliers or developers before you need them.

- Market/competition:

- Can bigger companies copy your idea? Are customers actually willing to pay your prices? Research your competitors, understand what makes you different, and build customer relationships that competitors can’t easily steal.

- Management/team:

- What happens if your business partner quits or your best employee gets hired away? Know your team’s skills, define clear roles and responsibilities, and have backup plans for key positions.

- Financial:

- What if sales drop 50% or your key client cancels their contract? Track your spending and always know how many months you have before you run out of cash. Smart business owners organize their finances in a way that supports long-term sustainability of their business by covering 12-18 months of bills.

McKinsey research shows that planning ahead makes a huge difference during tough times. Companies that prepared for problems performed way better during the 2008 crisis. The key is preparing your responses before problems hit, not after.

5. Improves Decision-Making

Your plan creates a framework that guides decision-making in critical situations. Writing a business plan makes you answer key questions ahead of time, before emergencies force quick choices.

Key Benefits:

- Reference established criteria instead of making gut decisions

- Evaluate and prioritize opportunities based on your target market and finances

- Understand how each decision impacts your overall business strategy

- Make faster choices during stressful periods

Running a business means making countless decisions and handling crises. Your business plan helps you think through big choices before you’re under pressure.

Take a fitness studio owner who set a rule in her plan: classes need 8 people to be profitable. When a yoga class kept getting only 5 people, she quickly canceled it instead of hoping it would improve. She replaced it with a popular bootcamp class that met her target.

6. Helps Track Progress and Adjust Strategies

Your business plan creates targets so you can track real results against your predictions. This comparison measures the success of your strategies and shows what works, what doesn’t, and what needs fixing to reach your goals.

However, plans must stay flexible and adaptive in today’s changing environment. External factors shift constantly – the economy, competitors, regulations, customer habits, and unexpected crises like COVID-19.

Regular reviews let you make strategic changes based on actual market feedback rather than assumptions. Netflix is a perfect example. Their original plan focused on DVD rentals, but they kept tracking the market and saw that streaming was the future. By staying flexible and adjusting their strategy, they became the global entertainment giant we know today.

7. Assists in Prepping for Different Situations

Business planning prepares you for multiple scenarios by making you think through various “what if” situations. This preparation helps you respond quickly when unexpected challenges or opportunities arise.

Your plan should include best-case, worst-case, and most-likely scenarios. This process prioritizes business initiatives for each situation and stops you from panicking during critical moments.

Take Kodak as an example. They invented the first digital camera back in 1975, but ignored the technology while competitors like Canon and Sony embraced digital photography throughout the 1990s. By the time Kodak entered the digital market in the early 2000s, they were already behind and filed for bankruptcy in 2012.

8. Ensures Legal and Regulatory Compliance

Your business plan forces you to research and understand the specific legal requirements that apply to your business before you start operations.

Key Compliance Areas:

- Business licensing and permits required in your location

- Industry-specific regulations (health codes, safety standards, professional certifications)

- Tax obligations at the federal, state/provincial, and local levels

- Employment law requirements if you plan to hire staff

- Zoning restrictions for your business location

Research reveals these requirements upfront, lets you budget for compliance costs, and build proper procedures from day one.

Skipping compliance planning causes more than just fines. Rule violations can shut you down temporarily, cancel your insurance, or stop you from getting permits to expand.

Consider a home baker who got a warning requiring commercial kitchen licensing for online sales within 90 days. She needed $4,350 for licensing and insurance and had to stop her growing online business during the transition, losing $3,000 in holiday sales.

9. Guides Marketing and Sales Strategies

Your business plan outlines the strategy for marketing and sales activities so that they align with your overall business goals instead of using random tactics.

The plan establishes target customer profiles, competitive positioning, value propositions, and success metrics that guide all customer activities. This consistency creates stronger brand recognition and better customer acquisition.

Your business plan must address four essential marketing elements:

The 4 Ps Framework

- Product: Define what you sell and why customers need it. This approach communicates the value proposition of your business and resonates with real customer problems.

- Price: Set how much you charge and explain why it’s worth it. Strategic pricing reflects your positioning, covers costs, and maximizes profit while staying competitive in your market.

- Place: Decide where and how customers buy from you. The right distribution channels reach your target audience efficiently and support your brand.

- Promotion: Plan how you communicate your value to customers. Consistent messaging across all channels builds trust and guides prospects through your sales funnel.

Take Spotify as an example. They saw that music lovers were frustrated with expensive albums and illegal downloading. So they built a solution that offers free access with optional premium upgrades, social features that let friends share music, and smart algorithms that learn user preferences. By aligning their product, pricing, and marketing, they completely changed how people listen to music.

10. Helps Manage Cash Flow and Finances

Your financial plan is the backbone of your business plan and the section investors examine most closely.

Planning forecasts financial outcomes for your venture, creates realistic budgets, and identifies funding requirements. This helps demonstrate the sustainability of your business model and prevents the cash flow problems that kill 82% of failed small businesses, according to recent studies.

Key Questions Your Financial Plan Answers:

- How much funding do you need to become profitable?

- When will your business become cash flow positive?

- What are your biggest expenses, and how do they scale?

- Which comparable companies have similar margins and growth rates?

- Do customers buy more during certain seasons?

Your plan establishes financial benchmarks for revenue, expenses, and profitability that guide spending decisions and help identify potential cash flow gaps before they become serious.

Good financial planning also helps you identify optimal timing for major investments, expansion, or additional funding rounds based on projected cash flow.

Consider Maria’s Bakery. Her business plan projected 40% lower sales in January and February after the holidays, so she set aside cash reserves for these slow months and waited until spring to buy new equipment. This prevented emergency borrowing that killed three competing bakeries within two years.

What are the Key Elements of a Business Plan?

Results-driven and well-organized business plans usually follow a similar structure, though the specific details vary based on your industry and goals.

These are the core sections that businesses should include:

- Executive Summary

- Brief outline of your business concept, financial requirements, competitive advantages, and funding needs

- Company Description

- Detailed explanation of your business structure, industry analysis, target market, and unique value proposition

- Market Analysis

- Comprehensive research on industry trends, market size, customer demographics, and growth opportunities

- Competitive Analysis

- Assessment of direct and indirect competitors, their market positioning, strengths, weaknesses, and your competitive advantages

- Organization and Management

- Overview of your business structure, ownership, key leadership roles, and personnel

- Products or Services

- Description of what you offer, development stage, intellectual property, research and development activities, and future product plans

- Sales and Marketing Plan

- Detailed strategy for customer acquisition, pricing strategy, distribution channels, and promotional tactics

- Operations Plan

- An overview of production processes, facilities, equipment,, and how your business manages operations effectively with structured workflows

- Financial Projections

- Three to five years of projected income statements, cash flow statements, balance sheets, and break-even analysis

- Funding Request

- Specific amount of capital needed, intended use of funds, and proposed terms for investors or lenders

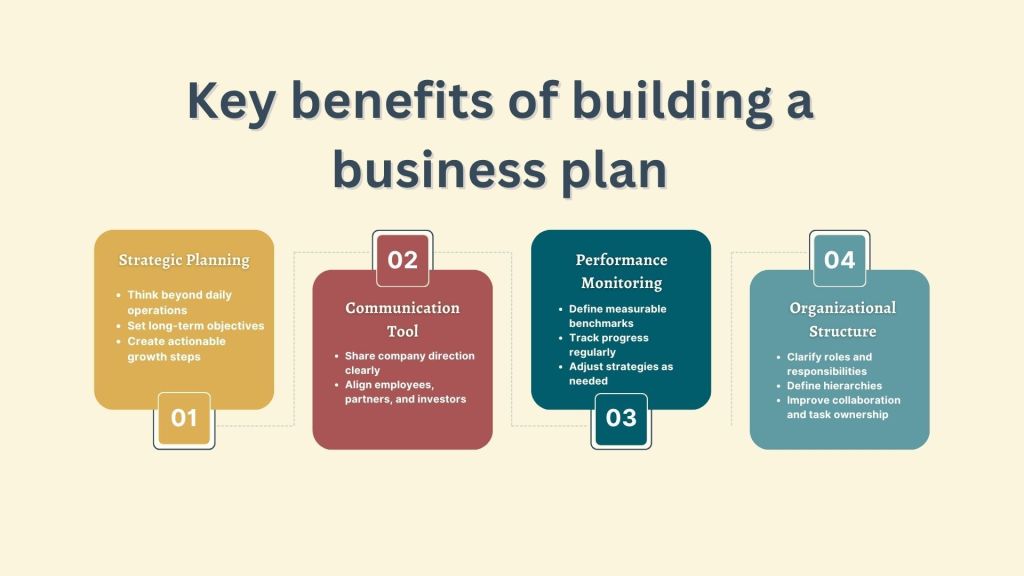

Top Benefits of Having a Business Plan

Building a business plan creates benefits that improve your ability to manage your business effectively. Here are the top 4 advantages:

1. Helps in Strategic Planning

Business plans force you to think beyond day-to-day operations and develop transparent strategic objectives.

Strategic planning makes you set long-term goals and create actionable execution steps to achieve these objectives over multiple years. This approach improves the planning process for growth and organizes the resources for market expansion.

2. Acts as a Communication Tool

A business plan clarifies the vision of your company and ensures everyone understands your direction, priorities, and expectations. This eliminates confusion and guides team commitments towards achieving shared strategic objectives.

For external stakeholders like partners, suppliers, and potential investors, your business plan provides the detailed information they need to evaluate collaborations or investment opportunities.

3. Facilitates Monitoring and Measuring Performance

Your business plan establishes specific goals and benchmarks that serve as targets for your business operations. As you run your business, you need to regularly monitor actual performance and compare it against the objectives you previously defined in your plan.

This comparison process reveals whether you’re meeting your targets and shows which strategies are working effectively versus those that require adjustment.

4. Improves Organizational Structure

Creating a business plan requires you to define roles, responsibilities, and hierarchies clearly within your organization. This process helps you identify skill gaps and areas needing additional expertise.

When employees understand their specific roles and how they relate to others, it improves collaboration and reduces confusion about who handles which tasks, ensuring everyone works together effectively toward your strategic objectives.

Case Studies of Successful Businesses that Thrived with a Business Plan

Below are two practical examples of visionary businesses that used business plans as strategic tools to identify market opportunities, secure funding, and guide critical decisions.

Case Study 1: Mountain Peak Coffee Roasters

Sarah Chen lost her corporate job in 2019 and decided to start a coffee roasting business in Denver. She noticed that local coffee shops were buying their beans from big companies instead of local roasters – that was her opportunity.

Sarah wrote down a structured business plan, including how much money she thought she could make each month (around $15,000 in the first year). This plan helped her get an $85,000 loan to buy the equipment she needed.

When COVID hit and everything shut down, Sarah wasn’t completely prepared (nobody was), but having a business plan meant she’d at least thought through some ‘what if’ scenarios. She quickly switched to selling coffee online and kept 60% of her sales going while other businesses struggled.

Three years later, Sarah’s business makes $350,000 per year and sells coffee to 28 local shops – even better than she originally hoped for.

Case Study 2: Little Learners Academy

Jennifer and David Park wanted to open a daycare center in their suburban community. They spent time researching all the rules and requirements (there were 47 different ones!) and figured out it would cost $23,000 just to meet all the regulations.

But they also discovered something important: their area desperately needed more childcare. Existing daycares had waiting lists six months long, and there was room for 340 more kids in their neighborhood. They planned to serve working parents who made between $45,000 and $85,000 per year.

Their detailed plan showed they’d start making money once they had 65% of their spots filled, which they expected would take about 14 months. Banks liked their thorough planning and gave them a $180,000 loan to get started.

Little Learners Academy filled up even faster than they expected – just 18 months to reach their full capacity of 80 kids. Now they make $485,000 per year, which is 22% more than they originally thought possible.

Key Takeaways

- Business plans create a strategic roadmap that keeps your team and external stakeholders aligned on the same vision and direction

- They establish measurable benchmarks that allow you to monitor performance and track progress against defined targets

- Your business plan attracts investors through solid market research and realistic financial projections, not just creative ideas.

Frequently Asked Questions

Can You Start a Business without a Business Plan?

Yes, you can, but it’s unwise and significantly increases your chances of failure. A business plan structures the goals of your business and gives you clear direction. Without one, you’re operating without market understanding or financial projections to guide important decisions. You’ll rely on guesswork rather than strategic analysis of your customers, competition, and operational requirements.

Should I Update My Business Plan Regularly?

Yes, you should update your business plan regularly to stay aligned with changing market conditions. Technology advances quickly, customer needs change, and new competitors enter the market constantly. Regular updates ensure your strategies remain relevant and your goals stay realistic based on what’s actually happening in your business.

How Detailed Should My Business Plan Be?

The level of detail depends on your business complexity and intended use. Traditional business plans can be dozens of pages long, while lean startup plans focus on the most important points and can be even one page. Choose a traditional format for funding applications and a lean format for simple businesses or frequent updates.

This article offers general information only, is current as of the date of publication, and is not intended as legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. While the information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Ventures Inc. or its affiliates.