As you are researching how to get into commercial investment, you may come across some terms that are unfamiliar to those new to the world of real estate. One of those terms, capitalization rate, refers to the approximate rate of return on a given property investment, or how quickly you will make money back on your investment. Needless to say, this is extremely important to calculate before you take the leap and invest a bunch of money, so aspiring real estate investors and agents will benefit from having a good cap rate calculator on hand at all times.

If you’re tired of putting off becoming an entrepreneur and you’re finally ready to dip your toes into commercial real estate investment, you need to know how to effectively use capitalization rate to your benefit. We’ve put together a comprehensive guide of everything you need to know about the cap rate in real estate.

What is Cap Rate?

A capitalization rate is calculated based on the yearly amount of income you believe you will earn on an investment property. It is the ratio of income to property value, which you’ll need to factor in when determining your budget for your real estate investment property. Capitalization rate can be helpful in comparing multiple potential investments and gathering information on how the properties function as businesses, as a real estate property may cost more upfront if it generates a higher rate of income or has less expenses, as compared to a lower initial investment.

A capitalization rate is expressed as a percentage that you can use to find out the monetary value of your property based on the current state of the real estate market by examining similar properties that are on the market or have recently sold. You should also note that a capitalization rate refers to the property’s value with the assumption that it is purchased in cash without a loan, and therefore it won’t take any mortgages or related loans into consideration.

How to Use Capitalization Rate

In order to use a cap rate formula to determine how much income your investment property is likely to bring in, you’ll need to start by looking at the price of sale and net operating incomes for similar properties. It may not always be easy for anyone to find out the operating incomes of other properties. While some real estate listings will mention this as a selling point, many property listings may not make their operating incomes publicly known.

If you’re running into difficulty finding out the yearly net operating incomes of the properties you’re interested in, you might want to try contacting a commercial real estate agent to get the inside scoop. Once you’ve determined the capitalization rate of properties similar to the one you’re looking into buying, you can apply it to your potential real estate investment property in order to determine its current market value.

As a real estate investor or agent, you might be interested in a cap rate calculator for selling a property as well as buying. An accurate cap rate formula can help you to establish how to appropriately price your property based on the capitalization rates for similar properties.

What is the Cap Rate Formula?

Understanding and using the cap rate calculator accurately is necessary for a real estate investor, whether you’re using your own money or applying for business funding. Start by making a note of the sale price of a similar property to those you are interested in purchasing. Then, find out what the net operating income of the property is. For apartment buildings, for example, this will be based on the annual net rental income. From this number, subtract the operating expenses, but not the mortgage payments. Next, divide it by the property’s sale price, and you will have the capitalization rate.

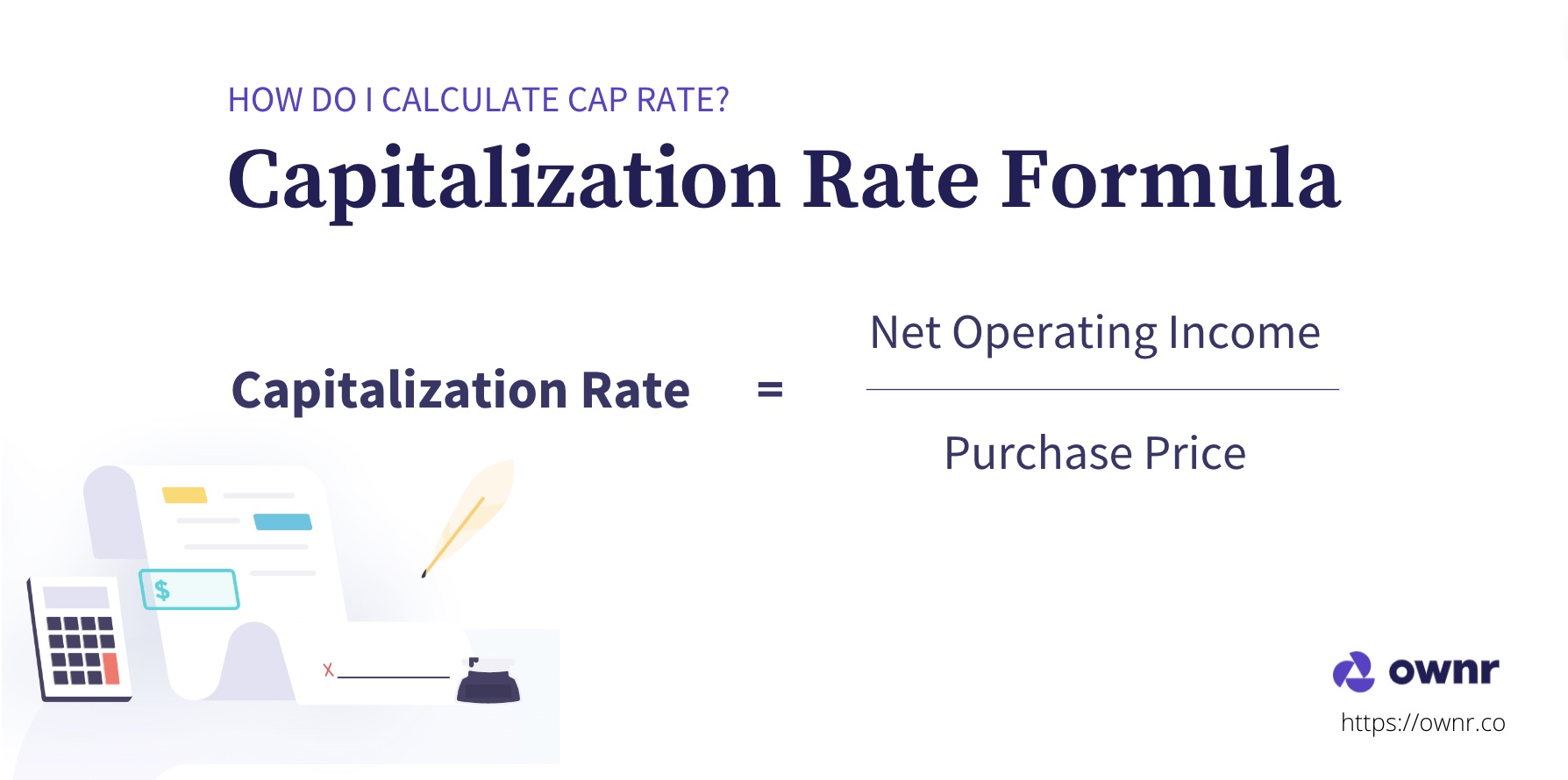

Use this cap rate formula to simplify things:

Capitalization Rate = Net Income / Purchase Price

Gross income minus operating expenses equals net income. Net income divided by purchase price equals the capitalization rate. Pretty simple, right?

After you calculate the capitalization rate of a few properties that are similar to the one you intend to buy or sell, take the average of the numbers. Then divide your property’s net operating income by the average capitalization rate of the other properties, and the resulting number will be the relative market value of your property.

If you do end up purchasing a real estate investment property, you will probably also have your property professionally appraised at some point in the process. Still, the cap rate formula can help you to gather the initial information on the approximate market value of your investment to make an informed investment decision. Plus, you can use the capitalization rate to determine the approximate number of years it should take you to earn back your investment, with a capitalization rate of 12 percent, meaning it will take 12 years to recover your initial investment.

What is a Good Cap Rate?

A good cap rate is typically considered to be 10% or less. However, what makes a capitalization rate good or bad depends entirely on the current real estate market and whether you are the buyer or the seller. A higher capitalization rate will mean that the property brings in more income as compared to the property’s lower valuation. A lower capitalization rate means that a property is lower risk, with more likelihood of making returns on your investment, whereas a higher capitalization rate carries more risk.

If you’re considering selling your property, you’ll want a lower capitalization rate, as this will mean that the overall value of your property is higher, so you’ll receive more money from the sale. When you’re looking to buy real estate, on the other hand, you may prefer a high capitalization rate because the upfront costs will be lower, which can help first-time investors who may not have access to the business capital required for a bigger purchase.

In order to get an accurate capitalization rate, you need to ensure that the properties you are using for comparison are similar enough to be relevant to your investment property. For example, if you’re thinking of buying a high rise, don’t plug the information for a nine-floor condo building into your cap rate calculator, as your results will be entirely skewed. Doing so won’t help you to gain a correct understanding of your investment options.

Examples of Capitalization Rate

Let’s say that you are considering purchasing a real estate investment property at $500,000. Look around for similar properties in the same size range and geographical location that have sold for around the same amount. Then gather the net operating income of each of these properties, subtracting all of the operating expenses, and divide it by the sales rate. Take the average of all of these. If the net operating income minus expenses are $50,000, then the capitalization rate is .1 or 10%. You can use this information to estimate that if the market does not significantly change, you will make back your investment in 10 years.

On the other hand, if you already own a property that you want to sell but you don’t know how to value it, you can use the capitalization rate to assess your investment’s worth. Start by finding a few properties that are comparable to yours and have recently sold, and fill in the cap rate calculator with their sale prices and net operating incomes to determine the capitalization rate. You can then plug the average capitalization rate for those properties into your cap rate calculator: net operating income for your property divided by cap rate will give you the value of your property. If your property’s net operating income is $40,000 annually, and the capitalization rate is 8.5%, the market value of your property will be $470,588.

As a buyer, you can use the capitalization rate to compare different properties that you are considering investing in. Instead of looking at properties that have recently sold, you’ll be gathering your information from properties that are currently on the market. This makes it more likely that you will be able to quickly and easily determine their net operating incomes for your cap rate calculator. However, you don’t have to accept their net incomes at face value. If you choose to look a bit more closely at their expenses and income, you may be able to find areas in which you can cut costs or increase rent prices to improve the yearly income of the property in question.

Aspiring real estate investors and agents can use capitalization rates to determine whether the property you want to invest in is worth its list price. For example, if the building you want to buy is listed at $450,000, you’ll need to use your cap rate calculator on similar listed buildings. Let’s say that the capitalization rate that you come up with is 8.2%. If the net operating income is $35,000, then the resulting market value is $426,829, meaning that the list price of $450,000 is not good value for you to invest in. In order for the real estate investment property to be worth $450,000 at a capitalization rate of 8.2%, the net operating income would need to be $36,900 per year. You can use this information to make an informed offer at the appropriate price based on your calculations.

When Should You Avoid Using Capitalization Rates?

Once you’ve become familiar with the cap rate formula, it can come in handy when you need to quickly size up a potential investment property. The capitalization rate can also help aspiring real estate investors who have been keeping a watch on market trends over the years, as you’ll be able to get a sense of where the market is going based on past rates, and use that to make more informed choices about what type of property to invest in and when.

If you’re looking to expand and grow your business, use your understanding of the cap rate calculator to put your small business grant to good use. Although capitalization rates can give you a great sense of the real estate market and can help you decide if and when to invest, it’s important that you keep in mind that since capitalization rates are determined based on the potential rate of return you expect from your investment property, and that rate of return is not definite, the information you gain from using a cap rate calculator should only be used as a guideline. The real estate market is always subject to change, so there is no guarantee that your property will meet the results of your initial cap rate calculator, but using the cap rate formula is usually a great place to start.

However, capitalization rates are not always helpful, depending on the circumstances of your intended real estate property investment. You can use the cap rate formula for simple calculations. But when it comes to properties with a more complicated or inconsistent income stream, you’ll need to use a more in-depth discounted cash flow (DCF) analysis to get an accurate understanding of the property’s situation and to determine the viability of the property as a real estate investment.

If you’re brand new to real estate investment, understanding how to use the cap rate calculator can save you from making a bad investment right away when first starting your real estate business.

This article offers general information only, is current as of the date of publication, and is not intended as legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. While the information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Ventures Inc. or its affiliates.