Whether you’re starting a new company or taking your sole proprietorship to the next level, incorporation could be the right step for your business. This guide provides a short summary of the steps required to incorporate a business under Alberta law, as well as some questions to determine whether it’s the right time for your business to incorporate. Let’s take a look at how to incorporate in Alberta and answer some common incorporation questions.

Choosing a business name

Choosing a name for your business can be a little stressful, but ultimately, it’s a fun exercise. There are five typical steps to confirming if a name is available. They don’t necessarily have to be completed in the order outlined below, but it is a good idea to go through each step before deciding to incorporate.

Step One: Ownr. As part of our incorporation packages, you’ll be granted unlimited name searches with our name search tool. You’ll be able to see if other businesses are using the same name as the one you’d like to choose.

Step Two: Domain name search. Next, you’ll want to check if a suitable domain is available. You can use a domain name registration service like Hover to search and see what’s available. Although most .com’s are taken, there are still plenty of .ca’s, .io’s, .co’s, and other TLDs available. Another option many new businesses and startups choose is to add “get” “go” or “my” at the front of their business name to get an available domain name (i.e. www.getrhinoicecream.com).

Step Three: Legal requirements. It is recommended to include all three legal parts to your business name:

[Distinctive] + [Descriptive] + [Legal Ending]

For example: Rhino Ice Cream Inc.

That being said, there are many companies that simply have a distinctive element (i.e. Apple Inc.). The difficulty with simply a distinctive element is it could be rejected by the Corporate Registry office, meaning that additional costs would need to be incurred to choose a different name with a descriptive element.

When you choose to set up a corporation with Ownr, you’ll also be able to see if your chosen name satisfies the legal requirements as part of your setup.

Step Four: Trademark search. You should check if anyone has already registered a trademark for your desired name. The Canadian Intellectual Property Office (CIPO) makes it easy using their online search.

When conducting a search, you will want to consider alternate spellings. If your name is similar to one that is already registered, you may not be able to use it if it is likely to cause confusion to consumers.

One final note about Trademarks: they are tied to specific goods or services. This means that you may still be able to use a desired name if your intended use is in a different industry. A trademark lawyer can help you navigate the ins and outs of any issues relating to trademarks.

Step Five: NUANS search. Finally, you’ll need to get a NUANS search done. We’ve already written at length about NUANS searches. Note, however, that it’s common when you incorporate to obtain the NUANS search and the incorporation all at the same time.

Final words of advice, if you’re stuck and having trouble finding a name that works, these business name generators can be useful and fun:

What is a numbered company in Alberta

For business owners who can’t, or would rather not, settle on a name, there’s the option of choosing a numbered company. In simple terms, a numbered company operates under a number assigned by the Alberta Corporate Registry rather than a distinctive name. ‘Alberta’ is always included after the number, and then a legal element. So you may receive a numbered corporation name like: 123456 Alberta Ltd. This might be a good option for corporations that will only hold assets and not conduct any day-to-day business operations.

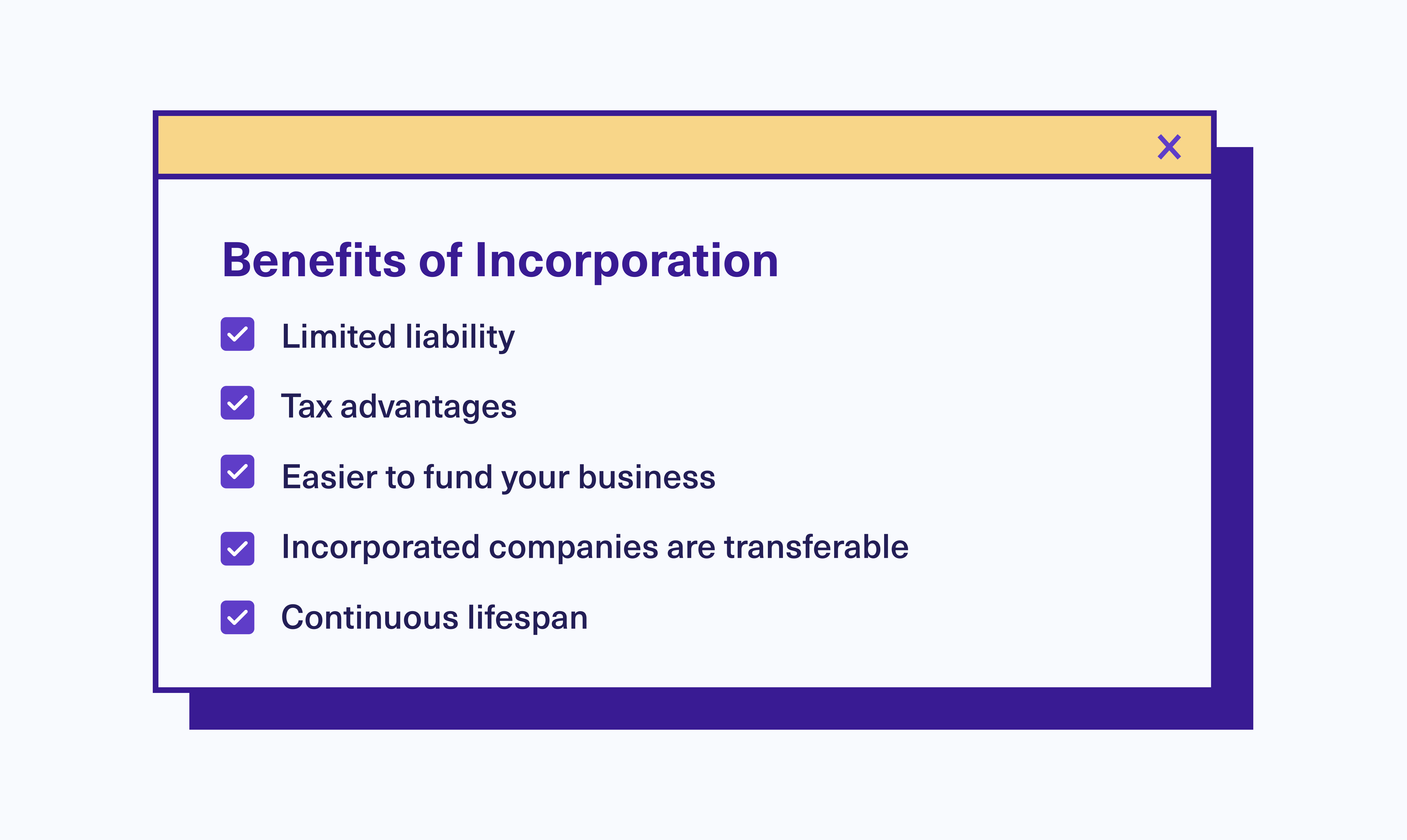

Benefits of incorporation

The two main benefits to incorporation are limited liability and tax advantages.

Limited liability. By incorporating, you will separate your personal and business obligations. Therefore, if your company goes south, your personal assets will remain protected and untouched. It is important to remember that directors of corporations may remain on the hook for unpaid employees’ wages in specific instances and unpaid taxes. This is different than if you remained a sole proprietor or a general partner in a partnership, as you would remain personally responsible for the debts of the business.

Tax advantages. Corporations are taxed differently than individuals. Generally, tax rates for corporations are lower than tax rates for individuals. Also, corporations are subject to flat rates of tax, where individuals are taxed on a progressive basis.

Additional benefits include:

Raising money. It is easier to fund your business and raise money from investors as incorporated businesses can sell shares.

Transferable. Incorporated companies can be transferred amongst individuals by simply selling shares and succession planning is considerably easier.

Continuous lifespan. Corporations are not limited to the lifespan of the owners. They can exist indefinitely.

Drawbacks of incorporation

The primary drawback to incorporation is the added expense. There will be the initial cost to incorporate your company as well as ongoing accounting and annual filing costs. Also, a corporation requires additional ongoing paperwork and record keeping. Thankfully, we’ve automated all ongoing corporate maintenance when you incorporate with Ownr.

Where to incorporate: federal vs. provincial

In Canada, you have the option of incorporating provincially or federally. If you choose Federal, you’ll also need to extra-provincially register the company in Alberta.

The differences between incorporating provincially or federally are often exaggerated. Both allow the company to operate in all provinces and service clients from anywhere in the world. There are a few key differences, which we’ve highlighted below:

Alberta incorporations

- Incorporated pursuant to the Alberta Business Corporations Act (ABCA)

- Generally, less ongoing paperwork

- Corporate name is only registered in Alberta

- $50.00 charge for filing Annual Returns

Federal incorporations

- Incorporated pursuant to the Canada Business Corporations Act

- Generally, more ongoing paperwork for federally incorporated companies (Federal and Provincial Annual Returns are required)

- Corporate name is registered throughout Canada

- $20.00 online charge for filing Annual Returns online ($40.00 if done offline), plus a $50.00 charge for filing the Alberta Extra-Provincial Annual Return

It is important to note that protection of a corporate name is not the same as a trademark and you won’t have exclusive rights to your corporate name until you register a trademark.

How to incorporate your company

Now we get to the most important part: how to incorporate your company. In very general terms, there are three different ways to incorporate in Alberta.

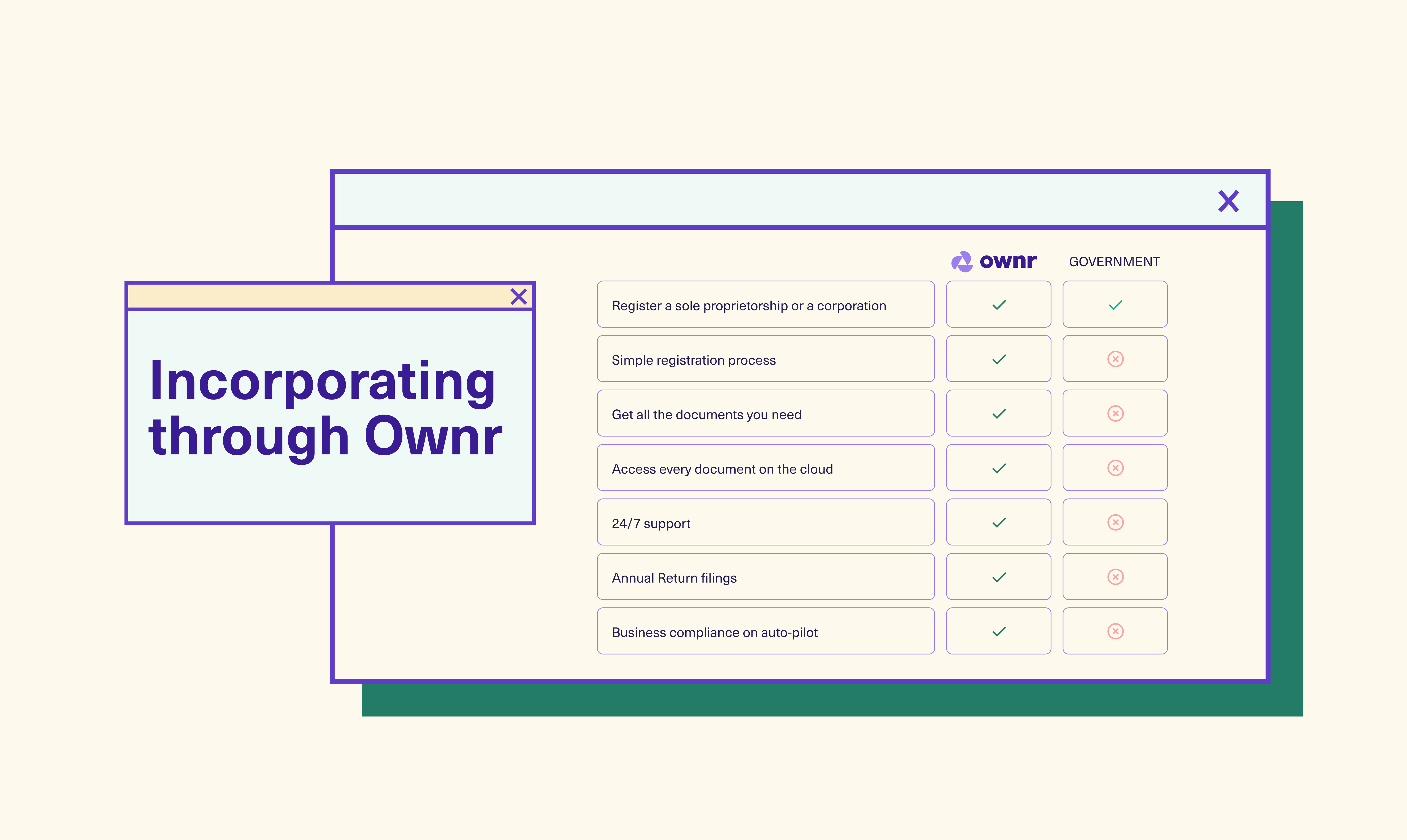

Incorporating through Ownr

At Ownr, we’ve made incorporating easy and affordable. Here’s what makes Ownr different:

One affordable price. With Ownr, you can incorporate your company through our intuitive platform. We explain everything in simple terms, so you can feel confident navigating this process. Processes that typically take weeks, involve stacks of paper, and cost thousands of dollars, have been transformed into quick, paperless, and affordable tasks that require no legal expertise.

Corporate organizational documents. Company bylaws, shareholder and director resolutions, share issuances, and more are all automated through Ownr. This means that you’ll get all the incorporation documents that you would normally get if you went to a law firm, tailored to your business, and you’ll save time and money in the process.

Automatic company updates. Anytime your company details change (like when you want to add a new director or change your address), Ownr automatically takes care of the paperwork: filing forms with the government, preparing the required corporate resolutions, gathering eSignatures, and securely storing all documents back into your account.

Secure and organized online storage. Once you’ve incorporated, all your company’s legal documents are organized and securely stored in your Ownr account.

Do it yourself (DIY)

First, you can incorporate yourself. Not surprisingly, we don’t recommend this approach. But it’s important for us to explain why.

You might think that the obvious advantage of doing it yourself is the cost. When we really dig in, however, you can see why that isn’t really the case:

No corporate organizational documents. The biggest issue is that by doing it yourself, you only obtain half of what is required when incorporating. It won’t provide you with a minute book comprised of the necessary corporate organizational documents: Shareholder Resolutions, Director Resolutions, Shareholder, Director and Officer Ledgers, Share Certificates, and Bylaws. These are significant, legally required items that simply aren’t provided when doing it yourself.

One-size-fits-all approach. This means that you won’t be able to set up various share classes and you’ll be stuck with the default one share class. Alternate share classes can be extremely useful for adding non-voting shareholders or investors who will likely want preferred shares. There are also reasons why you may want multiple voting share classes if there is more than one shareholder.

- Alberta Incorporation Information: Incorporation can be completed at a Registry Office. More information can be found here. The Government fee for incorporation is $275.00 plus the cost of a NUANS search. Corporate Registry offices throughout the Province will also have an additional administrative fee that is approximately $225.00, making the total cost of incorporation over $500.00.

- Federal Incorporation Information: You can read more details here. Cost for named incorporation including disbursements (NUANS search): $225.00. There is also an additional Government fee to Extra-Provincially register the company in Alberta of $275.00 plus Corporate Registry fees which equals approximately $200.00. The total fees for incorporating a Federal Company in Alberta will be over $700.00 if you do it yourself.

Law Firms

The traditional method that many small businesses use to incorporate is to contact a local law firm. All of the concerns with the DIY approach are removed: you’ll get customized advice from your lawyer that fits your company’s future goals as well as all the necessary corporate organizational documents.

The downside with the traditional method: the cost is high and the process is entirely offline. Incorporating through a traditional law firm can range in price from $1,200 –$1,800. Also, you’ll need to call the law firm, set up an appointment, and either drive to the lawyer’s office to pick up the documents or have them couriered to you (at your cost). That cost won’t include the ongoing support that Ownr offers—with each new task, amendment, or return, you’ll be asked to pay again.

This article offers general information only, is current as of the date of publication, and is not intended as legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. While the information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Ventures Inc. or its affiliates.