Are you an entrepreneur with a great business idea, but can’t decide on the legal structure? You may want to register your business as a sole proprietorship for a simple, low-cost start. Understanding the differences between a sole proprietorship and a corporation is a critical step that directly impacts a number of key areas of your business, including your tax rates. As a sole proprietor, you report business income on a personal tax return. A corporation operates as a separate entity and often pays lower tax rates.

In this guide, we will weigh the benefits and drawbacks to help you choose the right business structure for your new business.

Key Takeaways

- Sole proprietorships are simple and low-cost, but the owner is personally liable for all business debts and pays personal income tax on profits.

- Corporations offer limited liability and lower small-business tax rates, but they are more complex to set up and maintain due to extensive paperwork and associated costs.

Ownr simplifies the legal process and helps you register your sole proprietorship or incorporation quickly so you can focus on business growth.

What is the difference between a sole proprietorship and a corporation?

The main difference between a sole proprietorship and a corporation is liability and taxation. A sole proprietorship has unlimited personal liability and is taxed as personal income. A corporation limits liability to business assets and is taxed separately. Corporations also require more regulations and formalities.

Our comparison below helps compare business structures available to Canadian entrepreneurs.

| Sole Proprietorships | Corporations | |

| Features |

|

|

| Benefits |

|

|

| Drawbacks |

|

|

Ownr helps you register a sole proprietorship or incorporate quickly and easily. Make your new business official today.

Sole proprietorship: benefits and considerations

Sole proprietorships are the most common form of business organization in Canada. Let’s first explore what this business structure is and why so many Canadians choose to register their business as sole proprietorships.

What is a sole proprietorship?

Simply put, a sole proprietorship is a business structure in which an individual owner assumes on all the legal responsibilities, profits, and debts of the company.

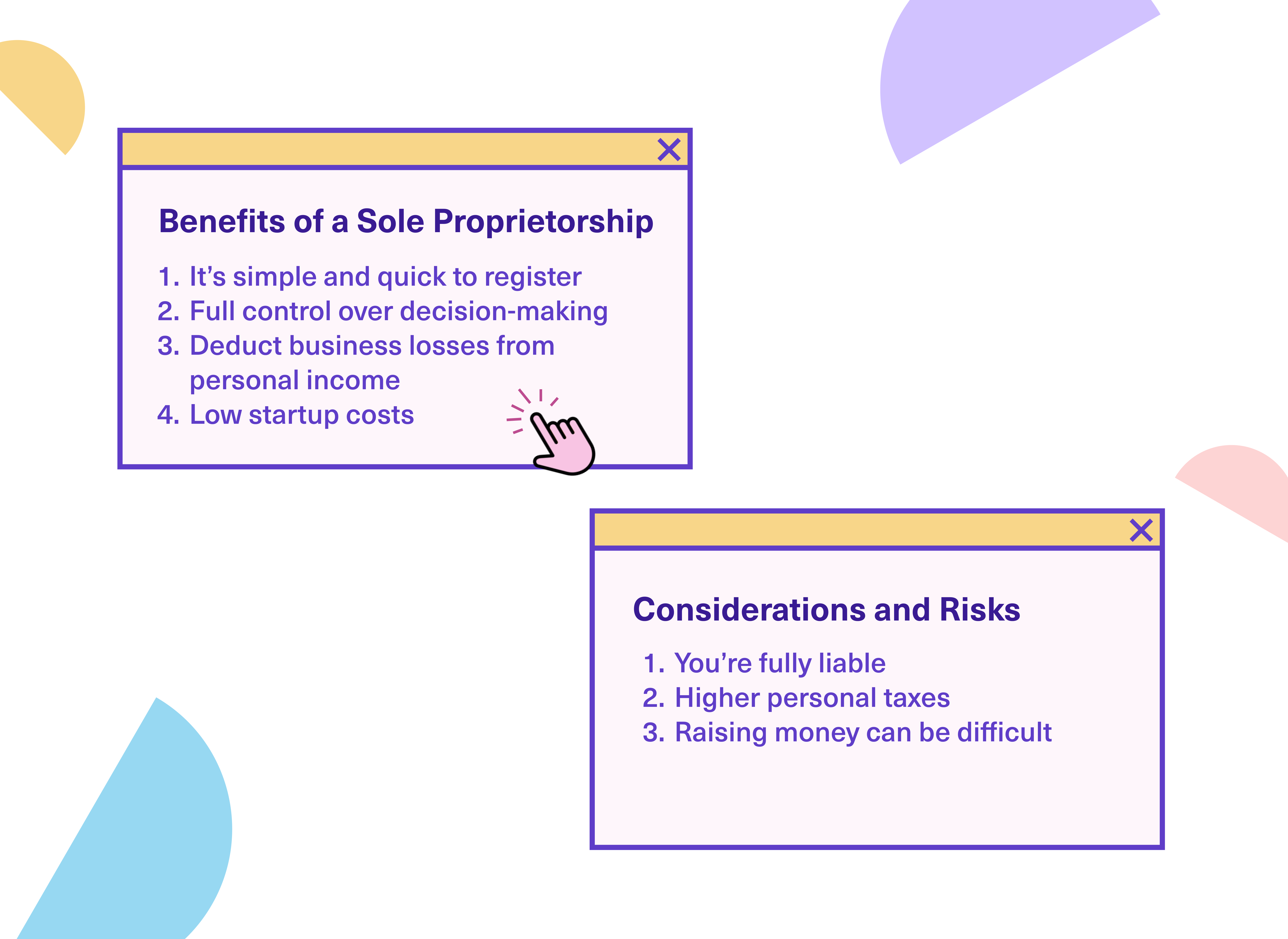

Benefits of a sole proprietorship

There are many benefits of registering your business as a sole proprietorship.

1. Simple and quick registration

Registering as a sole proprietorship is the simplest business structure. Setup can take mere minutes if you choose to register your business as a sole proprietor with Ownr.

2. Full control over decision-making

By registering as a sole proprietor, there’s no need for board or shareholder approvals. As the sole owner, you have complete control over the company’s business decisions.

3. Deduct business losses from personal income

You can claim business deductions for your company’s losses to influence personal income taxes and remain in a lower tax bracket.

4. Low startup costs

Registering your business as a sole proprietorship has the lowest associated costs. Register your business with Ownr for a one-time fee of only $49.

Considerations and risks of a sole proprietorship

While sole proprietorships offer many benefits, they also entail trade-offs. Here are some of the cons of a sole proprietorship.

1. You’re fully liable

If your business incurs debt, you are personally responsible. It’s that simple.

2. Higher personal taxes

If your business becomes super profitable, you’ll personally pay higher taxes. While high profits are certainly a benefit, it’s important to know you may jump to a higher tax bracket as your business’s finances improve.

3. Raising money can be difficult

Sole proprietors can have more difficulty raising capital than incorporated businesses. Financial institutions and investors may require your business to be incorporated before they grant you a loan or invest.

Incorporation: benefits and considerations

Incorporation is the third most common type of business (after sole proprietorship and general partnership agreements), with many entrepreneurs starting out with sole proprietorships before incorporating. Here are the most common reasons why entrepreneurs make the leap from sole proprietorship to incorporation.

What is an incorporation?

An incorporation is a business structure in which the company operates as its own legal entity. Once you decide to incorporate your business, it’s no longer simply an extension of your work and income; it becomes its own distinct legal entity separate from the owners.

Incorporation provides greater liability protection for you as a business owner than sole proprietorships or general partnerships. Before deciding to incorporate, you’ll also have to choose whether to do so under provincial law or federal law.

Let’s look at some of the advantages and disadvantages of incorporating your business.

Benefits of an incorporation

There are many advantages to registering your business as a corporation.

1. Limited liability

This means your exposure to any retribution as a business owner—should your business not do well and incur debts or losses—is limited. In most cases your personal assets cannot be seized for debts incurred by the business. Corporations are separate legal entities and owners are not personally responsible for the business’s financial and legal liabilities.

2. Ability to transfer ownership

Once incorporated, owners can transfer ownership if they decide to sell the business.

3. Easier to raise capital

Incorporating a business opens the door to additional financing. You’ll have more funding opportunities because you have the option to sell shares, making it easier to raise capital from investors and financial institutions.

4. Legacy and estate planning

An incorporated business theoretically exists forever and will be treated as an asset that lives beyond the life of the owners to eventually be taken over by a beneficiary. It’s important as a business owner to create an estate plan for the beneficiary of the business so affairs are in order and they are not left with heavy taxation.

5. Lower tax rates

A corporation’s business income will be taxed at the federal or provincial corporate tax rate. The corporate tax rates, in general, are lower than personal income tax rates. Corporations can also benefit from additional tax deductible business expenses.

Considerations and risks of incorporation

Though there are extensive benefits to incorporating, there are also risks. It’s important to consider the following concerns.

1. Stricter regulations

Once incorporated, your business must abide by strict regulations that require accurate paperwork.

2. More fees and higher costs

The startup costs of setting up a corporation are higher than those of a sole proprietorship. The cost of registering your business as a sole proprietorship is generally under $100 ($60-$80 for the registration fee, plus additional fees for your official business name search). Incorporation costs start at around $200 for a federal incorporation fee and can cost as much as $350 for provincial incorporation, based on the province or territory. Additional fees for the business name search will also apply.

3. Potential for internal conflict with shareholders

Including shareholders and directors in your small business opens up the potential for internal conflict and disagreements.

4. Additional (and ongoing) paperwork filings

There’s a lot more paperwork involved with corporations, including yearly documentation that must be filed with the government. You must maintain ongoing paperwork filings to continue to operate.

5. Additional legal formalities

The formality of filing “articles of incorporation” may sound daunting, but it doesn’t have to be as overwhelming as you might think. Read on for more information on articles of incorporation, or check out Ownr’s complete guide to articles of incorporation.

What are articles of incorporation?

Articles of incorporation are legal documents that describe the structure of your business and define it as a separate legal entity. If your business is incorporated federally, the governing agency is the Government of Canada. If it is incorporated provincially, it’s the respective provincial or territorial government.

These documents also ensure your business follows specific rules concerning company ownership. For instance, both federal and certain provincial corporations must meet director residency requirements, which stipulate that at least 25% of a company’s directors must be Canadian citizens or permanent residents. If a company has fewer than four directors, at least one must be a Canadian citizen or permanent resident.

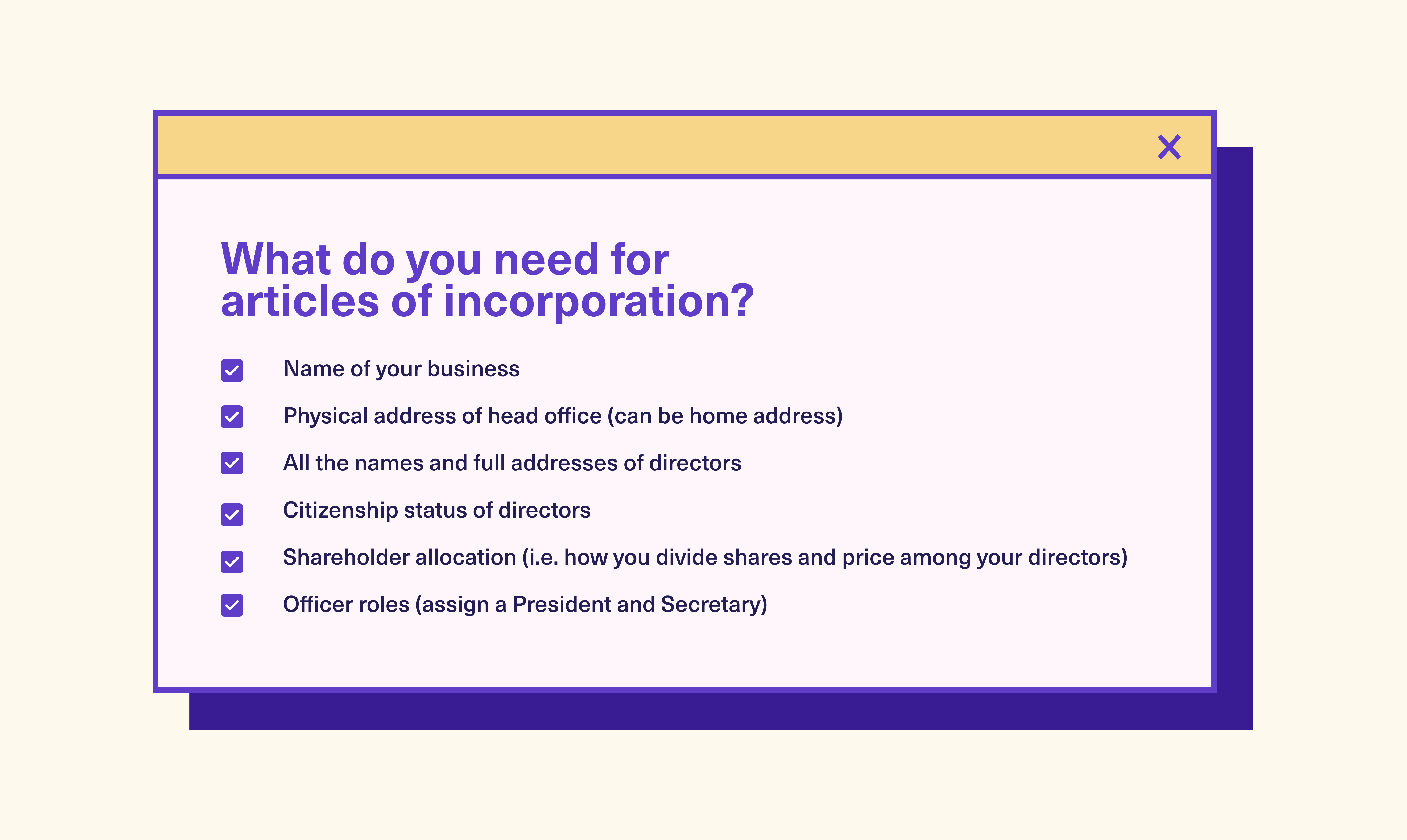

What do you need for articles of incorporation?

Below is the information you’ll need to prepare in order to file your articles of incorporation—a process that Ownr guides you through when you create an account and incorporate your business.

- Name of your business

- Physical address of head office (can be home address)

- Full names and addresses of all directors

- Citizenship status of directors

- Shareholder allocation (i.e., how you divide shares and price among your directors)

- Officer roles (assign a President and Secretary)

Do I need articles of incorporation for a sole proprietorship?

If you are registering your business as a sole proprietorship, you do not need articles of incorporation. Articles of incorporation are only necessary for a corporation as they are documents that define the company as a separate legal entity.

Should you choose a sole proprietorship or incorporation?

If you’re unsure which of the two you should choose, the best bet is to opt for the structure that fits your current budget and your business goals.

When to choose a sole proprietorship

If you are experimenting with a new business idea and are not sure whether you will pursue it long term, a sole proprietorship may be your best option. As a sole proprietor, you can operate under a unique business name with a simple tax structure without incurring high startup fees or investing a lot of time and effort to set up your business.

When to choose incorporation

Consider incorporating if you have multiple owners or plan for rapid growth. You immediately maximize personal asset protection, optimize tax rates, and gain easier access to capital.

Moreover, incorporating early builds credibility with suppliers and lenders, which is essential if you need loans later. So, do not wait to make this decision.

Whether you choose a sole proprietorship or a corporation, Ownr makes the process simple. We handle the legal structure so you can focus on growing your business.

Sole Proprietorship vs Corporation Taxes in Canada

Tax obligations are an important factor in choosing your structure, since the difference in tax rates can be significant. This section provides insight into tax implications to help you plan effectively.

Sole Proprietorship Taxes

As a sole proprietor, the government views you and your business as the same person. You report all business income on your personal tax return (T1).

Canada uses a progressive tax system, so as your income rises, your tax rate increases.

- Pros: Simple tax filing. You can deduct business losses from other personal income.

- Cons: High earners pay high taxes. In some provinces, the combined top personal tax rate can exceed 50%.

Corporation Taxes

A corporation is a separate legal entity. It files its own tax return (T2) and pays taxes on its own profits.

The most significant advantage is the Small Business Deduction. If your company is a Canadian-Controlled Private Corporation (CCPC), you pay a much lower tax rate on the first $500,000 of active business income.

- Tax Deferral: You can leave profits inside the corporation to reinvest. You only pay personal taxes when you withdraw that money as a salary or dividend.

- Lower Rates: The combined corporate tax rates for small businesses are significantly lower than personal rates.

| Province | Fed Small Bus. Rate* | Prov Small Bus Rate | Total Small Bus. Rate | Fed Personal Rate (Top) | Prov Personal Rate (Top) | Total Personal Rate |

| Ontario | 9.00% | 3.20% | 12.20% | 33.00% | 20.53%** | 53.53% |

| Quebec | 9.00% | 3.20% | 12.20% | 27.56%*** | 25.75% | 53.31% |

| Alberta | 9.00% | 2.00% | 11.00% | 33.00% | 15.00% | 48.00% |

| British Columbia | 9.00% | 2.00% | 11.00% | 33.00% | 20.50% | 53.50% |

*Rates apply to the first $500,000 of active business income for Canadian-Controlled Private Corporations (CCPCs).

**Ontario Personal Rate includes the provincial surtax (effective rate).

***Quebec Fed Rate reflects the 16.5% Quebec Abatement.

Frequently asked questions

What is the main advantage of owning a sole proprietorship over a corporation?

The main advantage of owning a sole proprietorship over a corporation is the simplicity of the business structure. It can be set up quickly and cheaply, and you don’t have to worry about complicated documentation and filings.

What is the biggest disadvantage of a sole proprietorships?

The greatest drawback of sole proprietorships is the exposure to liability. Since a sole proprietorship isn’t a distinct legal entity, any legal or financial liabilities incurred by the business are automatically the responsibility of the business owner.

Do corporations pay less tax than sole proprietorship?

Yes, corporations generally pay less in taxes than sole proprietorships because they can benefit from corporate tax incentives.

Do you save money by incorporating?

It’s possible to save money by incorporating, since your business will be subject to lower corporate tax rates. However, the direct costs of setting up a corporation are higher than those for a sole proprietorship.

Can a sole proprietorship be incorporated?

Yes, if you already have a sole proprietorship you can incorporate your business.

What is the difference between a sole proprietorship and an LLC?

LLC stands for limited liability company, an American business structure that is not available to Canadians. A corporation is the Canadian analog to an LLC.

Can I be a sole proprietor and have an incorporation?

You can only be a sole proprietor and the owner of a corporation if the two businesses are separate. A sole proprietorship can’t be a corporation at the same time, since incorporating creates a separate legal entity.

What’s the difference between INC and LTD?

Inc and Ltd are common suffixes in the names of Canadian corporations. Usually, there isn’t an essential distinction between them.

This article offers general information only, is current as of the date of publication, and is not intended as legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. While the information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Ventures Inc. or its affiliates.